Oct 1, 2024

Rogo raises $18M Series A from Khosla Ventures to Build Wall Street’s First AI Analyst

I’m excited to announce that Rogo has raised an $18.5M Series A, led by Keith Rabois at Khosla Ventures, OpenAI’s first investors, with participation from Jack Altman, Mantis VC, BoxGroup, Company Ventures, ScOp Venture Capital, Original Capital and many others. This funding enables us to scale our team, create new and strengthen existing partnerships, and build Wall Street’s first trusted AI analyst. Keith, a renowned operator and visionary investor, has a proven track record of early investments in generational companies like Stripe, DoorDash, and Airbnb. We’re thrilled to welcome him to our Board and look forward to the immediate impact he’ll bring.

Building the future of finance

Finance has a human resources problem: every firm’s most important resources are human, and humans process information slowly, make mistakes, and burn out when they reach their limits. The viral Goldman Sachs Working Conditions Survey put in plain English what the whole industry has long understood - smart analysts, who are hired for their competence, are retained for their pain tolerance.

When I was an investment banking analyst at Lazard, I looked up to the firms' extraordinary dealmakers as examples of finance at its best. I was mesmerized by how they effortlessly strategized with Fortune 100 CEOs, discussed macro trends, and navigated the complexities of M&A. They lived, breathed, and moved markets. If I could have instantly had that insight and experience, or have had more time to focus on the fascinating work they were doing, I might never have left banking. What frustrated me about finance was never the long hours––they were expected––but how hard it was to be as smart and knowledgeable as the men and women I so deeply admired.

Our mission at Rogo is to make firms –– and people –– smarter. Bankers need more than just a chatbot. We’re building Rogo to be every firm’s smartest analyst and every analyst’s most reliable teammate. Finance is an apprenticeship business and needs AI that drives efficiency and intelligence. As firms compete for top talent, we are motivated by the unprecedented demand for AI tooling across banking and private equity. And although industry leaders recognize the high cost of late adoption, many firms are still struggling to adopt an effective AI strategy. Most AI tools on the market today fall short, offering basic data access, simple chat functions, or limited automation of simple workflows. Back office tools are important, but the front office is where real strategic value is created.

Meet Rogo

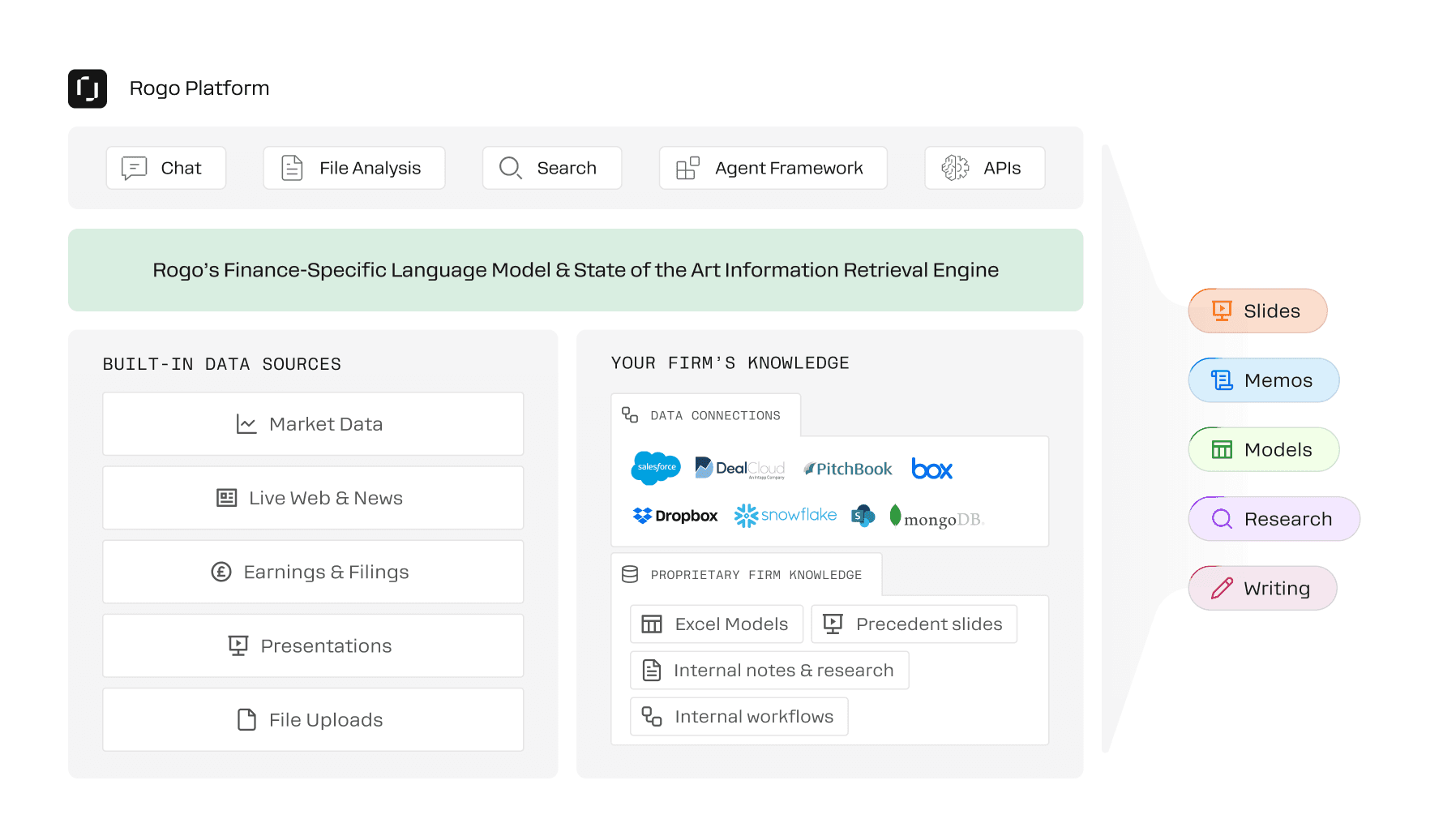

At Rogo, we understand that financial firms are built to deliver high-quality at high-velocity. Rogo is an enterprise AI platform built by and for finance professionals. We fine-tune language models to emphasize source citations, auditability, recency, and financial intuition. As a result, Rogo is significantly more accurate on financial tasks than other general purpose tools.

Our powerful AI platform is connected to a knowledge graph of financial data — hundreds of millions of research reports, filings, and internal documents — capable of instantly solving complex tasks, and we partner with firms to build custom AI solutions. We do so transparently, securely, and at scale, just as firms do for their clients.

Since launching in February, Rogo has witnessed meteoric growth:

Rogo has raised $26M to date from Khosla Ventures, AlleyCorp, BoxGroup, Jack Altman (AltCapital & Lattice CEO), Qasar Younis (Applied Intuition CEO), and The Chainsmokers’ Mantis VC.

Rogo’s platform metrics are best-in-class for accuracy and usage: Rogo is 2.42x more accurate than ChatGPT for finance using Patronus AI’s FinanceBench evaluation, and 1.8x more accurate for questions related to information past 2022 using the FreshLLMs dataset. Today, Rogo saves users an average of 400 hours per year – about 10 hours per week – on core analyst tasks.

Rogo doubled headcount to ~30 employees, bringing together world-class engineers, bankers, and investors from firms like Citadel and Blackstone. We continue to invest in our engineering team to accelerate new product development and make our core platform as intuitive and secure as possible.

Rogo is partnered with 25 firms nationwide, including leading public investment banks, private equity firms, and hedge funds. We are in the process of expanding within these firms by identifying new use cases for all business units.

We continue to enhance our platform by partnering with AWS, Azure OpenAI, Together, and Anthropic for enterprise-focused AI infrastructure optimization.

And we are just getting started. Just between now and the end of the year, we're on track to double revenue and expand our banking footprint significantly.

Firms need partners, not chatbots

We believe that a platform for everyone ends up serving no one. Just as Goldman Sachs wouldn’t outsource their analyst training, leading firms won’t fully outsource the development of their AI analyst. That’s why we reject the traditional “buy-or-build” approach. We believe firms need strategic partners that elevate capabilities and deliver tailored solutions.

Today, Rogo offers three key products to our partners:

AI Analyst: An LLM-powered answer engine supercharged with the right data, security, and integrations for financial users.

Agent Framework: A suite of purpose-built agents designed for all types of out-of-the-box financial workflows, including:

PowerPoint creation

Research compilation

Private company screening

Benchmarking analysis

Excel modeling

And many more tailored solutions

Rogo Platform: Finance is an apprenticeship business, and we want our Analyst to learn how your firm thinks – and learn fast. Technical teams can use our APIs and SDKs to pair agents together and develop cost-effective, scalable AI solutions tailor-made for internal use cases.

If you want to trade 100-hour workweeks for 100x productivity gains, schedule a demo to see how other companies run on Rogo.

And if you are just as excited about redefining how financial work gets done and financial data is consumed, please visit our careers page – this is only the beginning.

Gabe Stengel

CEO, Co-Founder

More articles

Meet the Rogo team: Curt Janssen

Article

·

13/03/2025

Meet the Rogo team: Curt Janssen, AI Engineer

Welcoming Our New Head of Applied AI: Joseph Kim

Article

·

13/02/2025

We’re thrilled to announce that Joseph Kim, one of the world’s leading experts in AI and search, has joined us as our Head of Applied AI. He joins us from Google Search.

Meet the Rogo team: Aidan Donohue, AI Engineer

Article

·

28/01/2025

Meet the Rogo team: Aidan Donohue, AI Engineer